https://usataxfighters.org/wp-content/uploads/2019/09/throwing-money-away.mp4

Washington Township’s leadership has announced a ballot proposal that fleeces the small municipality for at least $52 million. This story is rife with irregularities as well, including bailouts and more.

WE put the time in to get a solid analysis. What you find may shock you.

Freedom of Information requests reveal Bombshell information about the Washington Township Total Sports Soccer Stadium Bailout

Washington Township, MI–

1. Special 32% Property Tax Cut for Total Sports in 2019!

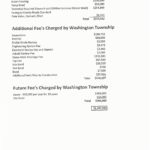

Total Sports Soccer Stadium Business owners claimed their Facility and land was only worth $5.3 million in a March 14, 2019 petition to the Washington Township Board of Review and was granted a special 32% tax cut ($39,845). By State law, the Washington Township Board has the power to overturn tax reductions, but choose to approve of the special 32% tax cut.

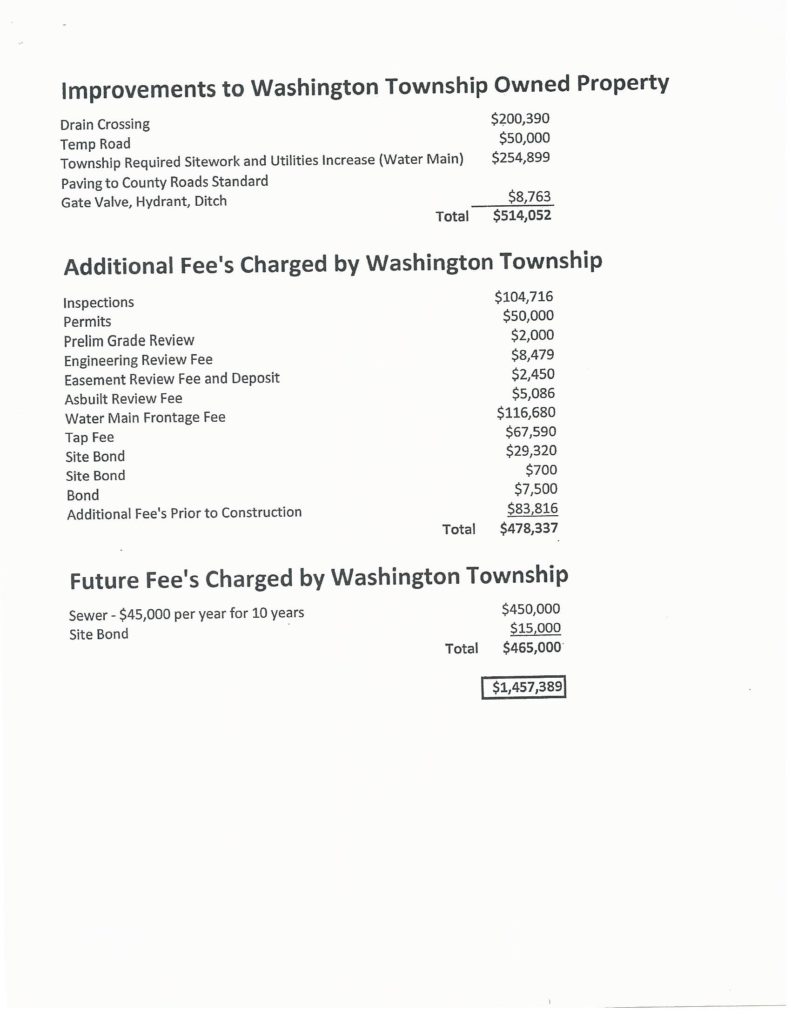

2. Washington Township wants to pay $11.5 million which is $6.2 Million (217%) over what Total Sports and Washington Township said Total Sports was worth!

A few months after the 32% tax cut to a $5.3 million valuation, Washington Township agrees to buy Total Sports Soccer Stadium for $11.5 million–a 217% increase! When It Comes to Real Estate, Is It Ever OK To Overpay? Let alone DOUBLE the valuation?

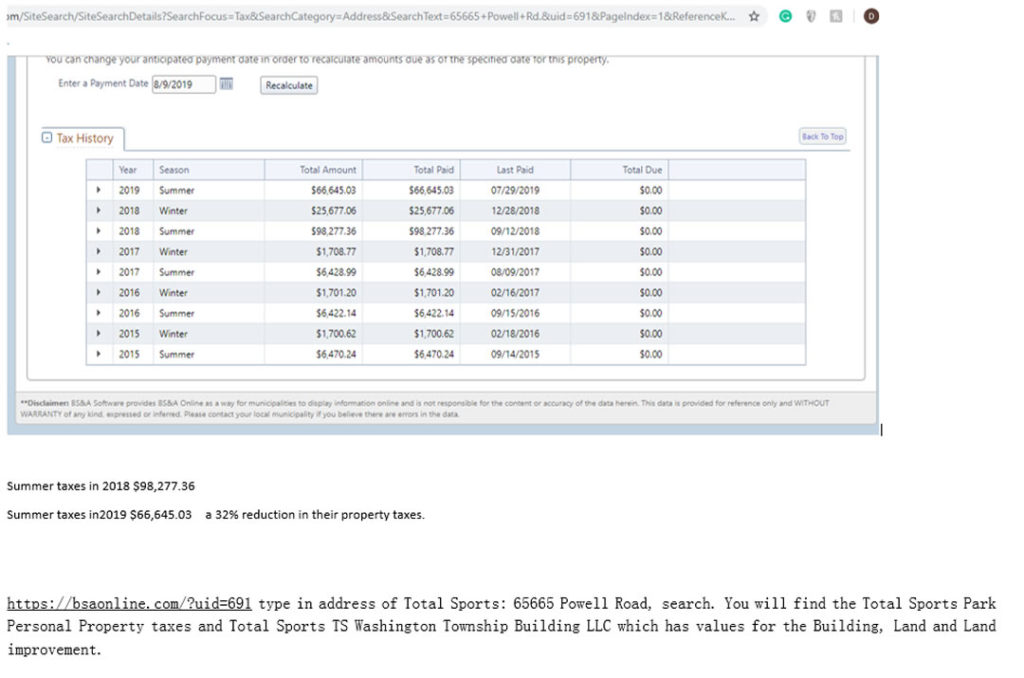

3. Taxpayers will have to pay Total Sports Stadium’s $464,000 Sewer bond obligations if voters approve a 20-year $30 million tax increase to purchase Total Sports Soccer Stadium.

4. Taxpayers shouldn’t buy a money-losing, Sports Stadium. Total Sports lost $42,284 in 2018.

5. A Washington Township Government takeover of Total Sports Stadium Business means Schools and governments will lose over $7 Million in taxes. Rejecting the Total Sports Facility Bailout would keep Total Sports paying approximately $7 million in property taxes plus state and federal income taxes and state sales tax for our schools and governments. Government-run facilities don’t pay taxes. Government-run Sports stadiums are money losers in Michigan (Pontiac Silver Dome, Joe Louis Arena, Pontiac Piston Summit Palace) and around the country.

6. Washington Township Board approved 6-1 a November 5, 2019; 20-year tax $25 million increase to pay for the $11.5 million Total Sports Soccer facility. One approving board member is a Real estate broker. Moreover, the Supervisor has recently claimed victory in helping to stop Macomb County corruption. The Total Sports Stadium take over will result in over $51.5 million in tax increases, new spending, and lost tax revenues. Total Sports Stadium business is already offering recreation services–at no obligation to taxpayers!

7. Questionable Ballot Procedure: 20 Years vs. Typical 4 Year term. All previous Recreation tax elections were for a four-year period to regularly force governments to prove their programs are running efficiently. This is a sneak attack special election with fewer than 8% of Washington Township voters expected to vote. The Recreation millage doesn’t expire until December 31, 2020. The special election will cost approximately $12,000! A regular election in 2020 is no additional cost to taxpayers.

Total Sports Tax Cut:

Previous

Next

Washington township Assessors Tax Cut Report

Total Sports Sewer Fees

Forfeited Taxes

the History of Government Owned/Subsidized Stadiums

Previous

Next

For about $52 Million or more…

Leave A Comment